Governance

lThe board’s roles and responsibilities

(i)Oversee the incorporation of climate-related considerations into the investment and risk management processes;

(ii)Oversee progress against goals for addressing climate-related issues;

(iii)Ensure the maintenance of sufficient human and technical resources for the proper performance of the management of climate-related risk;

(iv)Climate-related issues should be reported to the board and the board should meet at least annually.

lThe management’s roles and responsibilities

(i)The Head of Asset Management, the Investment Committee and the Risk Committee of OAML (collectively referred to as “the management”) are responsible for managing climate-related risks and reporting to the board.

(ii)The management of OAML should monitor the status and progress of efforts to managing climate-related risks through regular reporting or meetings;

(iii)Ongoing assessments of climate-related risks should be performed by investment team and risk team. The status and progress of efforts to manage climate-related risks in relation to investment management should be reported to the Investment Committee regularly. Climate-related risk of portfolios should be reported to the Risk Committee regularly.

(iv)Sufficient human and technical resources should be equipped for the proper performance of the duty to manage climate-related risks (eg, provide training to staff, engage subject experts and acquire climate-related data from external sources);

(v)Satisfactory internal controls and written procedures should be established to ensure compliance with internal policies and procedures as well as regulatory requirements related to the management of climate-related risks; and

(vi)The management should set goals for addressing climate-related issues and develop action plans for managing climate-related risks.

Investment management

lBaseline requirements

üThe following are the baseline requirements for the investment management of climate-related risks:

(i)Identify relevant and material physical and transition climate-related risks for each investment strategy and fund managed;

(ii)Where relevant, factor the material climate-related risks into the investment management process. For example, include climate-related risks in the investment philosophy and investment strategies and incorporate climate-related data into the research and analysis process; and

(iii)Take reasonable steps to assess the impact of these risks on the performance of underlying investments.

ü Where climate related risks are assessed to be irrelevant to certain types of investment strategies or funds under management, disclosure on exceptions should be made when the way climate-related risks is incorporated into the investment and risk management processes is being disclosed. Appropriate records should be maintained which explain why climate-related risks are irrelevant.

lIdentifying climate-related risks for investment strategies and funds

Any one or a combination of the following assessment approaches may be used to identify climate-related risks for different investment strategies and funds where appropriate:

üQualitative Approach

(i)Identify the impact by the transition to a low-carbon economy of sectors. For example, coal sector is more likely to be adversely affected and the PV sector is the opposite.

(ii)Identify the impact on those companies within the value chain of those sectors.

(iii)Analyze the impacts on portfolios by the transition to a low-carbon economy of sectors.

üQualitative Approach

(i)Use ESG scores (or scores of a similar nature) developed by third-party providers to identify investee companies subject to relatively higher climate-related risks.

(ii)Utilize third-party data tools to analyze a portfolio’s climate-related risks in the context of weather or climate data (e.g., five-year history of daily weather variables such as temperature and precipitation, extreme weather events including cyclones, earthquakes and drought) or projected climate conditions (e.g., the agreed rate of sea level rise in 10, 20 or 30 years’ time) and assess their likely impact on the portfolio.

(iii)Use third-party data tools to measure investee companies’ carbon footprints to assess the impact of carbon price changes or carbon tax on the investment portfolio’s value; or compare the total carbon footprint against a benchmark, another portfolio or peers to evaluate the magnitude of exposure of the underlying portfolio.

(iv)Integrate climate-related data as constraints in the portfolio construction process by setting an upper bound on a chosen carbon measure on an absolute or benchmark-relative basis.

üCompany Approach

(i)Assess the financial impact of physical and transition risks on each investee company’s business, strategies for products and services, value chain, operations and investment in research and development.

(ii)Assess the impact base on the financial model by adjustments arising from ESG regulation.

(iii)Evaluate the investee company’s climate report and form a view on company-level climate-related risks and their likelihood.

lFactoring material climate-related risks into the investment process

üBottom-up Stock Selection

(i)Assess the climate risks of investees companies. Use ESG score metrics, including but not limited to carbon emissions (scope 1, 2 and 3), third parties scores etc.

(ii)Conduct peer comparison by gathering information from potential investee companies such as their environmental and climate change policies, water use, gas flaring and waste management.

üCountry Risk Assessment

Assess the physical risks at the country level using metrics such as climate change policies, economic and population exposure to natural hazards, exposure to water and heat stress and overall country data on GHG emissions, waste management, air quality, biodiversity and deforestation. For example, flood risk and water stress data can be collected from World Resources Institute (www.wri.org).

lAssessing the impact of the climate-related risks on the performance of underlying investments

(i)Assess the financial impact of physical and transition risks on each investee company’s business, strategies for products and services, value chain, operations and investment in research and development based on the financial model quantitatively.

(ii)Assess the qualitative impact, such as reputation impact, by conducting peer comparison.

(iii)Assess the valuation impact of physical and transition risks on investee companies

(iv)The following table illustrates examples of climate-related risks and their potential financial impact:

|

Type |

Climate-related risks |

Potential financial impact |

|

Physical risk |

Acute |

·Reduced revenue from decreased production capacity (eg, transport difficulties, supply chain interruptions) ·Reduced revenue and higher costs from negative impact on workforce (eg, health, safety, absenteeism) ·Write-offs and early retirement of existing assets (eg, damage to property and assets in “high-risk” locations) ·Increased operating costs (eg, inadequate water supply for hydroelectric, nuclear and fossil fuel plants) ·Increased capital costs (eg, damage to facilities) ·Reduced revenue from lower sales or output ·Increased insurance premiums and reduced availability |

|

·Increased severity of extreme weather events such as cyclones and floods |

||

|

Chronic |

||

|

·Changes in precipitation patterns and extreme variability in weather patterns ·Rising mean temperatures ·Rising sea levels |

||

|

Transition risks |

Policy and legal |

|

|

·Increased pricing of GHG emissions ·Enhanced emissions-reporting obligations ·Mandates for and regulation of existing products and services ·Exposure to litigation |

·Increased operating costs (eg, higher compliance costs, increased insurance premiums) ·Write-offs, asset impairments and early retirement of existing assets due to policy changes ·Increased costs or reduced demand for products and services resulting from fines and judgements |

|

|

Technology |

||

|

·Substitution of existing products and services with lower-emission options ·Unsuccessful investments in new technologies ·Costs to transition to lower- emission technology |

·Write-offs and early retirement of existing assets ·Reduced demand for products and services ·Research and development expenditures for new and alternative technology ·Capital investments for technology development ·Costs to adopt or deploy new practices and processes |

|

|

Market |

||

|

·Changing customer behaviour ·Uncertain market signals ·Increased cost of raw materials |

·Reduced demand for goods and services due to shifts in consumer preferences ·Increased production costs due to changing input prices (eg, energy, water) and output requirements (eg, waste treatment) ·Abrupt and unexpected shifts in energy costs ·Decreased revenue resulting from changes in revenue sources and mix ·Re-pricing of assets (eg, fossil fuel reserves, land valuations, securities valuations) |

|

|

Reputation |

||

|

·Shifts in consumer preferences ·Stigmatisation of sectors ·Increased stakeholder concerns or negative stakeholder feedback |

·Reduced revenue from decreased demand for goods or services ·Reduced revenue from decreased production capacity (eg, delayed planning approvals, supply chain interruptions) ·Reduced revenue from negative impact on workforce management and planning (eg, employee attraction and retention) ·Reduction in capital availability |

|

Risk management

lMajor risks associated with climate change

The following major risks associated with climate change may affect asset values:

(i)Physical risks: Extreme climate-related weather events and progressive, longer-term shifts in climate patterns may have financial implications for companies either directly, such as from damage to assets, or indirectly from supply chain disruptions or reduced productivity;

(ii)Transition risks: Risks associated with the ongoing viability of a business as the high carbon economy transitions to a low-carbon economy (eg, reduced demand for commodities, goods and services with a high carbon footprint owing to changing consumer preferences or government policies); and

(iii)Liability risks: A person or company may seek compensation for losses caused by climate change.

lBaseline requirements

(i)Risk management

Climate-related risks should be taken into consideration in risk management procedures and appropriate steps should be taken to identify, assess, manage and monitor the relevant and material climate-related risks for each investment strategy and fund managed.

(ii)Tools and metrics

Appropriate tools and metrics should be applied to assess and quantify climate-related risks.

lEnhanced standards – Tools and metrics

üThe requirements for enhanced standards

Where OAML is defined as Large Fund Manager, if climate-related risks are assessed to be relevant and material to an investment strategy or a fund managed, the below standards should also be followed:

(i)Assess the relevance and utility of scenario analysis in evaluating the resilience of investment strategies to climate-related risks under different pathways. If the assessment result is deemed to be relevant and useful, develop a plan to implement scenario analysis within a reasonable timeframe; and

(ii)If climate-related risks are assessed to be relevant and material, identify the portfolio carbon footprints of the Scope 1 and Scope 2 greenhouse gas (GHG) emissions associated with the funds’ underlying investments, where data is available or can be reasonably estimated, and define the calculation methodology and underlying assumptions.

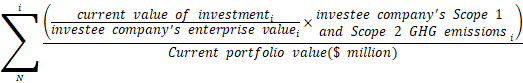

üCalculation of portfolio carbon footprint

Portfolio carbon footprint is a representation of carbon emissions normalised by the portfolio’s market value and expressed in tons of carbon dioxide equivalent emissions (CO2e) per million dollars invested. Below is the formula for the calculation of portfolio carbon footprint:

Note: Scope 3 should be included once data is available